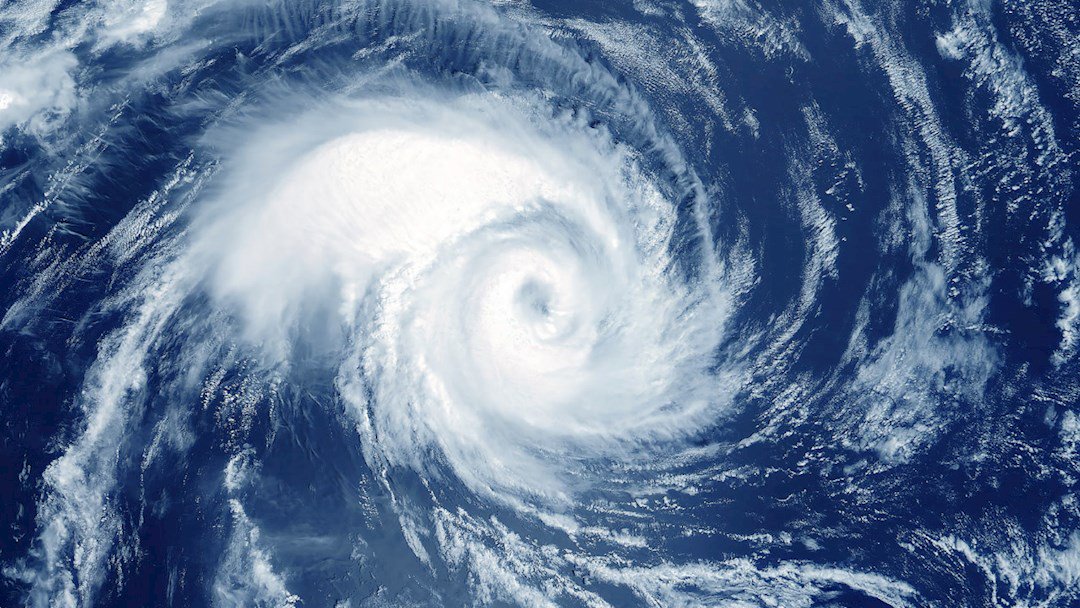

The 2024/25 UK storm season — punctuated by Ashley (October 2024), Bert (November 2024), Darragh (December 2024), and Eowyn (January 2025) — serves as a significant reminder of the challenges climate change presents for the UK insurance sector. The Verisk Property report states that storm losses were up 62% in the final quarter of 2024 compared to the third quarter, underscoring a trend that poses a critical challenge for insurers, who seek ways to adapt their models and strategies to cope with the evolving risk landscape.

Challenges for UK Insurers

The insurance industry in the UK faces several challenges as climate change escalates the frequency and severity of weather-related incidents. One of the primary challenges is accurately assessing and pricing risk. Traditional actuarial models, which rely on historical data to predict future events, are becoming less dependable, leading to potential underpricing of risk or, conversely, unaffordable premiums. Insurers and underwriters need live data to model in real time and make corrective and robust decisions.

Additionally, the operational challenges for insurers and their supply chains are magnified during and after significant weather events. The claims process can become overwhelmed with the volume of claims, leading to delays and dissatisfaction among policyholders. Insurers are pressed to improve their claims handling processes, leveraging technology and data analytics to expedite assessments and payments. However, the transition to more efficient systems requires investment and cultural shifts within many organisations, which can be slow to implement.

Within the supply chain, we've seen a substantial drop in the number of experienced loss adjusters, which has the potential to exacerbate these issues for insurers. Gallagher Bassett partners with a number of clients to deploy highly skilled claims professionals into Burst Resourcing teams that support our clients at peak surge periods.

Impact on Customer Experience

Extreme weather events present heightened customer service challenges, with policyholders navigating complex claims processes while coping with the emotional and financial toll of property damage. Insurers can ease this burden and enhance customer experience by prioritising transparency, proactive communication, and digital accessibility:

- Clear and timely communication about coverage, claims procedures, and expected timelines helps manage customer expectations and reduce frustration.

- Customer service training focused on catastrophe (CAT) claims ensures claims teams and suppliers provide empathetic support and clear guidance.

- Digital solutions, such as mobile apps and online portals, enable policyholders to track claims in real time, submit documentation seamlessly, and receive automated updates.

- Proactive support, including risk mitigation advice and preparedness resources, strengthens customer trust and loyalty while reducing future claims severity.

Key Learnings and Future Considerations

The challenges that climate change poses offer valuable lessons for insurers in the UK and Europe.

Invest in advanced climate risk modelling: The industry should prioritise enhanced climate analytics to refine risk assessments and pricing models, ensuring insurance products remain viable in an evolving climate.

Drive innovation in claims processing and customer service: Embracing artificial intelligence (AI), machine learning, and digital-first claims solutions can streamline operations and improve customer engagement, reducing processing times and enhancing policyholder satisfaction.

Strengthen supply chain resilience: Insurers should ensure access to skilled claims professionals, particularly during surge events. Strategies to achieve this goal can include partnering with providers like Gallagher Bassett to deploy expert resources when needed.

Enhance industry collaboration for climate resilience: Working with governments, businesses, and communities to advocate for sustainable infrastructure and climate adaptation initiatives will be essential in mitigating future losses.

Looking Ahead

The accelerating impacts of climate change demand a proactive and adaptable response from insurers across the UK and Europe. By acknowledging these challenges and embracing innovative solutions, insurers can safeguard their business interests while contributing to a more resilient future for their customers and communities.

Author

Julian Nicklin

Tom Overing

Make Gallagher Bassett your dependable partner

When making the right decision at the right time is critical to minimise risk for your business, count on Gallagher Bassett's extensive experience and global network to deliver.